Zoom COVID benefits in more ways than one!

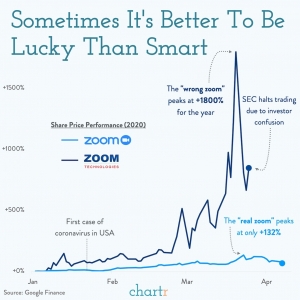

Zoom. The meeting app that has skyrocketed in popularity. Our friends over at Chartr have taken a look at it in a closer and have found a few things. They’ve have had a huge few months, their user base has increased twenty-fold and their share price has more than doubled. It’s gone on to become the go to communication tool for many of us in lockdown. However, another company called Zoom Technologies, a tiny company who have no affiliation to the video conferencing company.

Some people are investing. Some think that they’re investing in Zoom Communications (the real one) when they’re actually buying Zoom Technologies stock (the other one). Those mistakes have pushed the wrong Zoom companies price up to 1800%. Which is a tidy return for those who made the mistake early doors and benefited from others doing the same later on down the line. By the way here is where you can get buy Zoom shares.

Suspended Trading

To try and minimise the confusion and protect investors. The SEC (US Security and Exchange Commission) had to suspend trading in Zoom Technologies for a short period.

This has actually happened before. Zoom Communications went public in April 2019. Investors poured money into Zoom Technologies. Seeing their share price go from under a cent to almost $6 in a month. Other instances of these mistakes happening are, Twitter and Snapchat. When Twitter (TWTR) went public in 2013, investors bought Tweeter Home Entertainment (TWTRQ) stock. In one day increased their stock by 1,500%! In 2017 Snapchat (SNAP) went public, the stock price of Snap Iterative increased 164%

(Chartr)

Keep up to date with everything How To Kill An Hour by signing up to our newsletter by clicking here!

Let us know what you think of the show by clicking here!

Click here to subscribe to our YouTube Channel to see more amazing ways to kill time!

Follow us on Twitch by clicking here!